To be comfortable and financially secure in the future, boost retirement savings.

Starting a retirement fund can be tough because of the economy, personal financial constraints and the complexity of investment decisions.

This blog explores effective tactics to help you boost retirement savings.

1. Start Early

Time stands out as a tool that can be leveraged effectively when speaking about retirement planning. Starting to save for retirement can lead to increased advantages through compound interest. This basic financial principle has the ability to boost investments and allow them to grow over time.

Understanding Compound Interest

Compound interest occurs when the money made from investment begins to earn its money. This leads to an effect causing investments to increase at a rate as time goes on.

To break it down:

Principal: The initial amount of money you invest.

Interest: The return on your investment, calculated as a percentage of the principal.

Accumulated Interest: The interest earned over previous periods, which also starts to earn interest.

Compound Interest Benefits

Beginning investments early makes the most of compound interest. As time passes, this impact becomes increasingly noticeable. After 30 years, with no additional contributions, that initial $10,000 can grow significantly, purely due to the power of compounding.

Here is an example:

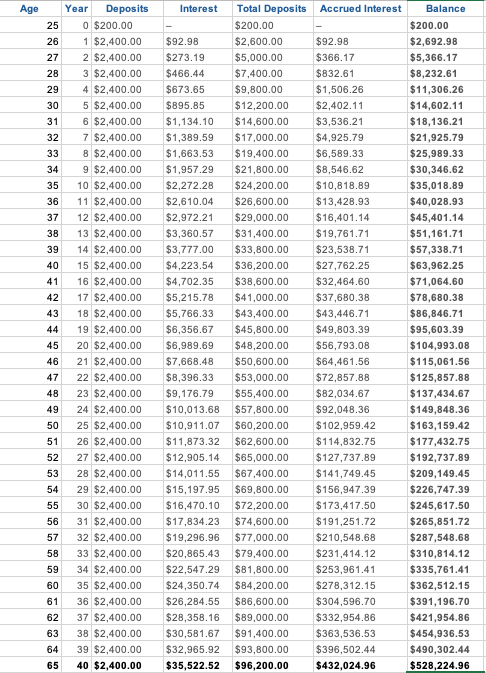

1) $200 a month to save at age 25. Take an average annual return of 7%, you could have: over $500,000 by reaching 65.

2) If you begin saving the same sum at 35, you’ll accumulate more than $200,000 by the age of 65.

Thanks to the magic of compounding interest, starting your retirement fund ten years earlier can result in a gap in savings.

2. Diversify Your Investments

Investing wisely involves spreading investments across assets to reduce risk and potentially increase profits. It’s a fundamental strategy in investing that can boost your returns. By diversifying investments into many types one can reduce the risk of losses in case one of them underperforms. This balance helps stabilise your portfolio over time.

What is Asset Allocation

Consider asset allocation as the way to spread out investment portfolio. This means dividing investments across types such, as stocks, bonds and cash.

The best way to slice the pie depends on a few key factors:

How

… do you feel about market fluctuations?

… long do you plan to keep your money invested before you access it?

What are your

… financial goals, retirement goals, are you buying a home or saving for your children’s education?

… financial priorities?

3. Reduce Unnecessary Expenses

Cutting unnecessary expenses helps in the allocation of more money towards retirement savings.

Take a look at spending. Pinpoint any unnecessary expenses that you could cut back on or eliminate. This could involve eating out, cancelling unused subscriptions, or seeking more budget-friendly options for specific services.

Use budget management and applications to monitor expenses and pinpoint areas where you can cut back. Developing a budget is key to staying within limits and emphasising the importance of saving money.

Redirect the money saved from cutting expenses directly into your retirement accounts. Even small amounts can add up over time, significantly boosting your savings.

4. Increase Contributions Gradually to boost retirement savings

Gradually increasing retirement contributions can substantially impact savings without drastically affecting your current lifestyle.Consider increasing your contribution percentage each year. For example, 3% of salary yearly is contributed, increase it to 3.5% next year and continue this pattern annually.Making incremental payments even how small can significantly grow retirement savings in the long run. For example, increasing contributions by 1% each year could yield tens of thousands of dollars upon retirement.Examples and Projections

If you start with a 6% contribution and increase it by 1% each year until you reach 15%, the compounded effect over a few decades can lead to a much larger retirement nest egg than maintaining a flat contribution rate.

5. Leverage Catch-Up Contributions

If over 50, you can boost retirement savings by contributing to retirement accounts as you approach retirement age.

These extra contributions can significantly enhance retirement savings, especially if you began saving to compensate for gaps.

6. Consider Part-Time Work During Retirement

Working a part-time job during retirement can help you earn extra money and avoid dipping into savings.

Part-time positions can also provide healthcare perks and engage one’s mind and body.

Explore career opportunities that match your abilities and passions, like consulting, freelance gigs or part-time roles in fields you love. Numerous seniors find job satisfaction that offers flexibility and a relaxed work pace.

Ensure that engaging in part-time work does not hinder your happy retirement. Striking a balance is crucial, for sustaining a vibrant and satisfying lifestyle.

7. Stay Informed and Educated

Staying updated on updates and consistently learning about retirement strategies can empower you to make informed choices and adjust to evolving situations.

Keep up with market trends, economic shifts, and new retirement planning approaches. Being informed about these aspects can help you make investment choices and adjust plans accordingly.

Financial markets and financial strategies to retirement planning is always changing. Keeping informed through education allows one to remain up-to-date and seize opportunities.

Recommended Resources

Explore a variety of sources, like books, financial websites, online courses and advice from experts to improve your knowledge and planning abilities.

8. Periodically Review and Adjust Your Plan

Check and revise the retirement plan to ensure it aligns with objectives and adapts to any shifts in life or the financial landscape.

Check the plan once a year. Life uncertainties, market variations and evolving goals might necessitate adjusting your approach.

Life milestones (whether good or bad) such as marriage, divorce, becoming a parent or changing careers can impact the way you plan for your retirement savings. Similarly, shifts in the market could lead you to reconsider your investment strategy and adjust your portfolio.

Utilise retirement planning tools and budget calculators. Seek guidance from experts to track your journey and make well-informed tweaks to your strategy.

Conclusion

Enhancing your retirement funds involves a procedure that demands a well-thought-out strategy.

You can build a substantial retirement fund by starting early, maximising employer contributions, diversifying investments, utilising tax-advantaged accounts, reducing unnecessary expenses, gradually increasing contributions, leveraging catch-up contributions, considering part-time work, staying informed, and regularly reviewing your plan.

Start saving for retirement soon. Take full advantage of employer contributions, spread investments across different options, use tax-advantaged accounts, cut down on unnecessary spending, increase contributions over time, make use of catch-up contributions when needed, think about working part-time, stay updated on financial matters and review your retirement plan regularly.

Why not take these steps today to secure a comfortable and financially stable retirement?

0 Comments